You may have heard about the ATO’s new policy to disclose non-compliant businesses with tax debts greater than $100,000 to Credit Reporting Bureaus. This is another tool available to the ATO to encourage taxpayers to manage and pay outstanding debts.

Recent market volatility, interest rate hikes, inflation, and ballooning tax debts through Covid, makes this a timely reminder for business and their advisors.

The ATO resumed debt collection activity in 2022, following a lengthy hiatus. The ATO has begun issuing warning letters, Director Penalty Notices and, recently, winding up applications. In negotiating payment arrangements with small to mid-sized taxpayers, the ATO are seeking mortgages over real property or bank guarantees as security, which is becoming challenging for business owners in a softening property market, with tightening credit.

To date, the ATO has been sparing in terms of disclosing tax debts to Credit Reporting Bureaus. However, the broader need for the government to engage in “budget repair” may prompt the ATO to take a harder stance when it comes to recovering tax debts from non-compliant taxpayers.

The risk to the business is obviously through their credit rating, where the public disclosure of defaults can impact their supply and financing facilities. Tax compliance and the management of tax debts are an important part of the credit assessment process. Public reporting of tax defaults brings this matter up front.

The key message for business owners is to engage with the ATO when tax debts escalate, either directly or through their trusted advisors. However, if the tax debts cannot be paid now, or over time by agreement with the ATO, then there are other options available to address operational and balance sheet issues as a whole. At BRI Ferrier, we are regularly engaged by businesses to explore restructuring solutions through formal processes such as:

- Safe Harbour advisory

- Small Business Restructuring

- Voluntary Administrations

- Liquidations

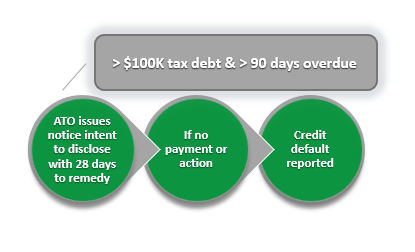

Below is a high-level summary guide to the ATO’s tax debt disclosure policy:

Applies to:

|

Process:

|

Remedy:

|

More information can be found on the ATO’s website https://www.ato.gov.au/General/Paying-the-ATO/If-you-don-t-pay/Disclosure-of-business-tax-debts/

BRI Ferrier helps financially distressed businesses to recover, change and renew. Should you or your clients need assistance, please contact us.