Restructuring Rabbit

In the wake of prevailing economic headwinds facing Australian business, you will likely be hearing about companies “Restructuring” in order to return to profitability, or indeed survive.

Such economic headwinds are a result of surging inflation, interest rates hikes, declining consumer confidence, supply chain constraints, a more assertive ATO and the like. Companies with highly leveraged balance sheets, declining revenues and an inability to access capital will be among the first to experience the financial strain and could fail, if they do not consider restructuring.

What is Restructuring?

At its most basic level, restructuring is the process of reorganising a company’s affairs and renegotiating its key contracts to a more manageable set of terms and obligations. A way to conceptualise this, is to view a company as a “nexus of contracts” as between its stakeholders (directors, owners, staff, suppliers, financiers and customers). The key contracts may be operational (leases, employee contracts, supplier contracts, joint venture agreements and so forth) or financial (terms and conditions of bank facilities, loans etc).

By renegotiating the key contracts it can assist:

- realign the financial obligations with longer-term strategic objectives and cash flows; and

- set a platform through which the business can raise new capital and attract new talent.

Financial Restructuring

A Financial or balance sheet restructuring is a means of seeking concessions from counter-parties to remedy shortfalls or to bolster the company’s financial position. Businesses in need of financial, rather than operational, restructuring may be profitable on an EBITDA basis, but not profitable enough to service its debt.

The concept can be implemented via a number of strategies, but typically results in the reduction of the overall debt composition in the business. Some examples include:

- Informal debt compromise agreements with a creditor(s)

- Debt-for-equity swap

- New debt or equity financing

- Debt-for-debt exchange, typically with deferred repayment terms

Operational Restructuring

Operational restructuring seeks to address shortcomings in the way the business operates. A company in need of operational restructuring may be unprofitable, even on an EBITDA basis, and the fixing the operational aspects would typically also require a financial restructure to fund the necessary changes in the business. Prime indicators that a business needs its operations restructured include:

- Incurring trading losses

- Costs & overheads excessive for size

- Unprofitable customer contracts or product mix

- Underperforming staff or divisions

- Underutilised or redundant assets

- Non-viable leasing or supply arrangements

Implementation – Informal vs Formal

The restructure process can be approached informally or formally, where key difference for the latter involves appointing an External Administrator to use the legal frameworks to bring about the needed results.

Informal Restructure

An informal restructure basically involves engaging with counter-parties (such as staff, suppliers or customers) to renegotiate contractual arrangements to make the operations profitable again. In circumstances where the business has a decent track record and there is a relationship between the parties, engaging in open and honest communication with a sense of commercial reality is an important initial step.

Where the stakeholders are manageable, such as a relatively small group of suppliers, an informal restructure is a viable option. The frank discussions as to the options and potential outcomes, can create a sense of urgency and minimise parties’ holding-out for improved terms which can be unfavourable to the cash flows and improvement strategies. A prime example where an informal approach is useful is where a business is seeking to surrender or renegotiate terms with landlords, and the costs of reletting the space is prohibitive.

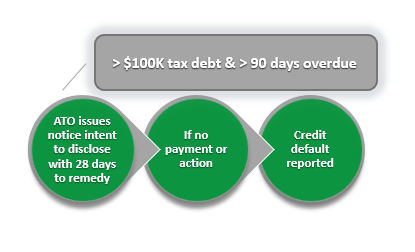

However, some creditors, such as the Australian Taxation Office may not engage in informal discussions. The ATO typically will not extinguish primary tax debts without due cause, however they may be agreeable to waive interest and penalties if the underlying debt is paid in full, over time. It is worth noting that with the Covid relief having finished, the ATO are less accommodating and instead they are actively pursuing directors where debts are unreported or unmanaged.

Safe Harbour Regime

Not all restructures can, or do, succeed. The Safe Harbour regime provides Directors’ protection from personal liability from insolvent trading, should a restructure process fail.

Under the Corporations Act, Directors of a company that traded whilst insolvent, can be pursued by a Liquidator for the debts incurred by that business. However, if implemented correctly, the Safe Harbour laws provides the directors a viable defence from liability, if the restructure fails and a Liquidator later brings an insolvent trading claim.

There are various threshold requirements for entering into the Safe Harbour, but the fundamental test that the Directors must satisfy is whether the restructure plan is

reasonably likely to result in a

better outcome for the company than the immediate appointment of an administrator or liquidator.

The Safe Harbour process typically suits medium to large businesses where the restructure plan is “realistic” and not just a hope. The process requires the Directors to engage an appropriately qualified advisor to assess the business and the restructure plan. That advisor typically prepares reports on the plan, which the Directors can later rely upon should the restructure fail, and a Liquidator pursues an insolvent trading claim. This is an important consideration when selecting the advisor, as the directors have the burden to prove the defence and the quality of the advisor’s report can become crucial in this regard.

The regime allows for the plan to be revisited and adjusted to suit the evolving circumstances of the restructuring process. To remain “in” the safe harbour, the company needs to continue to satisfy the threshold requirements, otherwise it falls outside of the protections, and formal restructuring options will need to be pursued.

Formal Restructuring - Voluntary administration

The primary formal restructuring tool is the Voluntary Administration (“VA”) process implemented under the Corporations Act. The appointment of Voluntary Administrators to a business is a serious step, as the control of the business moves from the Directors to the Administrators.

The objective of the VA is to provide a short period of time whereby options are explored to either:

- save the business and/or

- improve the return to creditors

Process runs for 4-5 weeks, during which all debts owed by the business are on hold. The law provides a framework aimed at providing time for the Administrators to explore options to save the business. To that end, the Administrators have the power to continue to trade, cease trading, terminate employees, repudiate underperforming contracts and leases, sell the business and a whole lot more (within the confines of law). Whilst this occurs:

- all creditor actions are on hold;

- landlords cannot enforce or evict;

- contracts cannot be terminated by the counter-party due to the company being in VA (ipso facto laws);

The outcome of the VA process is determined by creditors resolving by a majority in number and value, as to whether the Company should:

- Enter into a Deed of Company Arrangement (“DOCA”); or

- Be placed into Liquidation; or

- That the Voluntary Administration should end.

The key restructuring tool is the implementation of a DOCA, which is effectively a deal between the company and its creditors. The DOCA is a very flexible instrument which can compromise debts, provide time for repayment, raise capital, introduce new management, sell a business and much more. The key assessment for a DOCA is whether it is expected to deliver a better outcome for creditors, than a Liquidation scenario, which typically involves the business being shut down and all assets ‘liquidated’.

Small Business Restructuring

Another option recently introduced is the Small Business Restructuring Process (“SBRP”). It is similar to the VA process, however aimed at being quicker and more cost effective for small businesses.

A key aspect of the SBRP is that the control of the business stays with the directors while a proposal is put to creditors. Under this type of External Administration, if creditors don’t agree to the proposal the company doesn’t automatically go into liquidation, although that is probably where it will ultimately end up, as the SBRP is only supposed to be used by directors when the company is considered to be insolvent.

There are also some eligibility requirements to be able to qualify for the SBRP:

- Creditors are collectively owed no more than $1 million;

- All tax lodgements are up-to-date;

- All employee entitlements are up-to-date, including superannuation; and

- The company and its directors have not previously been through this process before within the last seven years.

Foundations of a Successful Restructuring

As has been set-out herein, there are many informal and formal strategies to pursue a restructure. However, at the core, there needs to be a commitment to save the business.

In our experience, for any restructure to succeed, the following elements must be present:

- A core Viable Business

- Competent Management

- Confidence of key Financiers, Suppliers, Employees and Customers

- Directors/Management open to Change

- Access to capital.

At BRI Ferrier, we have assisted many clients pursue various restructuring opportunities, all in an effort to reset their business for future growth. Our experience assists us identifying options which may otherwise be overlooked and by acting early more avenues are available for a successful restructuring process. If your business is at a financial crossroads, or approaching one, please contact BRI Ferrier for confidential and prompt advice.

More information can be found on the ATO’s website

More information can be found on the ATO’s website