The COVID-19 crisis introduces a new degree of complexity to quantifying economic loss due to the need to distinguish between the losses attributable to the complained of conduct and the losses attributable to the coronavirus. While COVID-19 and the complained of conduct are independent events, the timing of their intersection can have drastically different commercial consequences.

Thinking about the impact of coronavirus on a time series basis can help lawyers explain to their clients the importance of establishing the causes of loss and the need to apportion any losses between the two events. In turn, this helps avoid any inclination clients may have to simply attributing the entire loss suffered from both events to just one of those events.

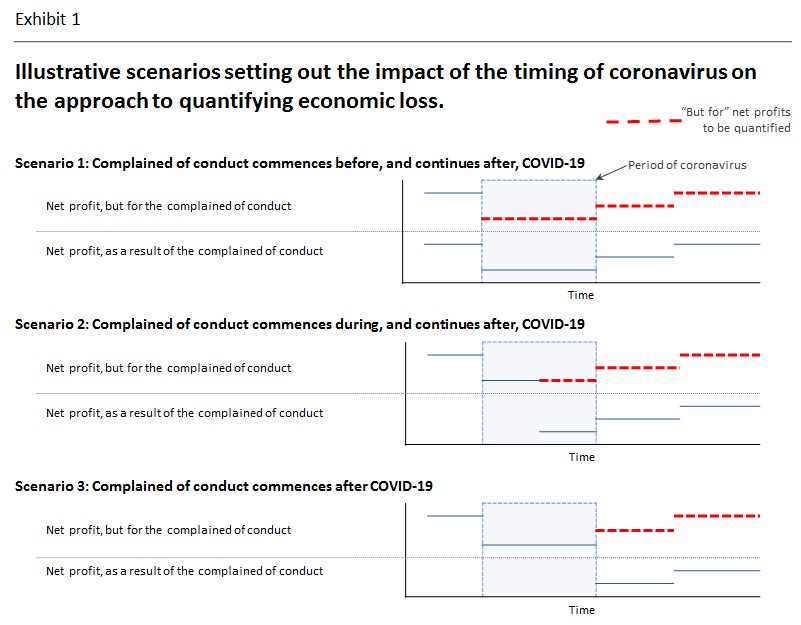

Understanding the timing of the intervening event (COVID-19) is a critical first step in quantifying economic losses affected by COVID-19. The three possible timing scenarios are set out in Exhibit 1. For illustrative purposes, net profits have been presented on a linear (time) basis, with the period over which net profits are expected to recover post-COVID-19 reflected by a stepped line.

In “but for” and the “as a result” cases under each scenario, the impacts of COVID-19 on the plaintiff’s business must be separated from the impacts of the complained of conduct on the plaintiff’s business:

- In the “as a result” cases, the level of difficulty in separating the losses increases with the period over which simultaneous loss occurs, and

- In the “but for” cases, the difficulty is exacerbated – particularly under Scenario 1 – because a “but for” COVID-19 reference point is unlikely to be evident from the historical financial information or may not even exist. While the degree of difficulty will reduce over time as the impacts of COVID-19 become clearer, it will not disappear until the transition to the post-coronavirus world is largely complete.

As the apportionment exercise won’t be an easy one, this framework also helps lawyers explain to their clients the inherent evidentiary challenges associated with unravelling the impact of the two intertwined events. Those and other associated issues will be explored in upcoming articles in our COVID-19 economic loss quantification series.

Need advice?

Early forensic accounting input may assist in developing the best legal strategy. We may be able to give a broad overview of the main issues after a brief review of available financials and an outline of the background to the matter. We aim to help, so please feel free to contact:

Paul Croft Jacqueline Woods

pcroft@brifnsw.com.au jwoods@brifnsw.com.au

+61 418 411299 +61 417 472668